Real Estate According to Sarah

Real Estate According to Sarah

There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices rise. When the supply of the item increases, prices fall. Of course, when demand is very high and supply is very low, prices can rise significantly.

Understanding the impact both supply and demand have can provide the answers to a few popular questions about today’s housing market:

According to the latest Home Price Insights report from CoreLogic, home prices have risen 18.1% since this time last year. But what’s driving the increase?

Recent buyer and seller activity data from the National Association of Realtors (NAR) helps answer that question. When we take NAR’s buyer activity data and compare it to the seller traffic during the same timeframe, we can see buyer demand continues to outpace seller activity by a wide margin. In other words, the demand for homes is significantly greater than the current supply that’s available to buy (see maps below):

This combination of low supply and high demand is what’s driving home prices up. Bill McBride, author of the Calculated Risk blog, puts it best, saying:

“By some measures, house prices seem high, but the recent price increases make sense from a supply and demand perspective.”

The supply of homes for sale will greatly affect where prices head over the coming months. Many experts forecast prices will continue to increase, but they’ll likely appreciate at a slower rate.

Buyers hoping to purchase the home of their dreams may see this as welcome news. In this case, perspective is important: a slight moderation of home prices does not mean prices will depreciate or fall. Price increases may occur at a slower pace, but experts still expect them to rise.

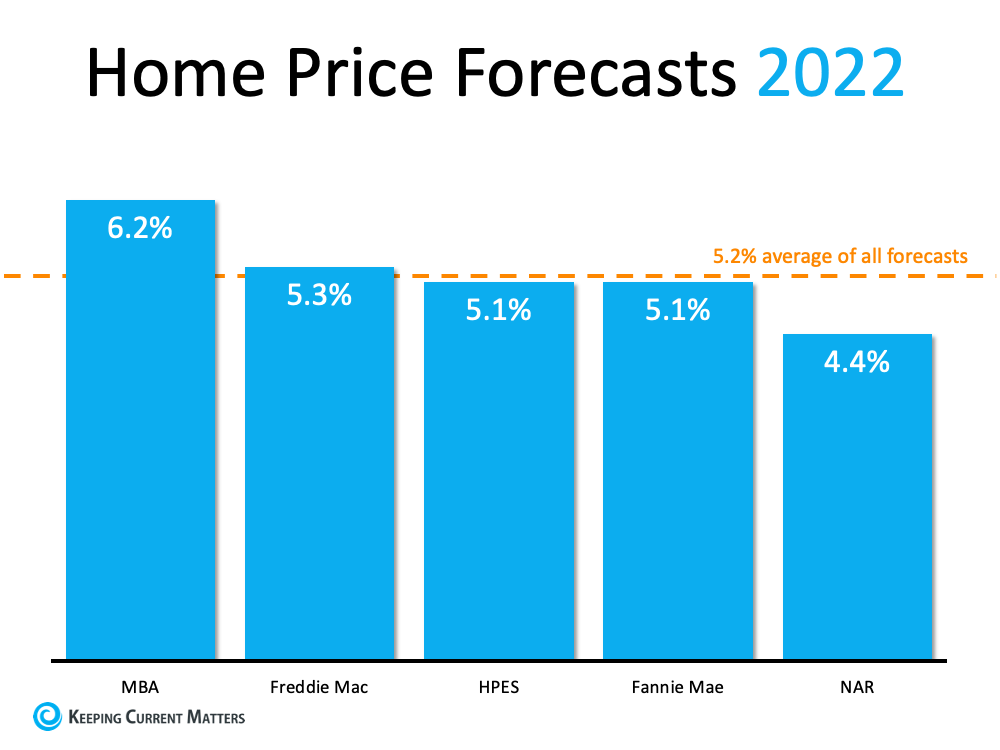

Five major entities that closely follow the real estate market forecast home prices will continue appreciating through 2022 (see graph below):

If you’re waiting to enter the market because you’re expecting prices to drop, you may end up paying more in the long run. Even if price increases occur at a slower rate next year, prices are still projected to rise. That means the home of your dreams will likely cost even more in 2022.

The truth is, high demand and low supply are what’s driving up home prices in today’s housing market. And while prices may increase at a slower pace in the coming months, experts still expect them to rise. If you’re a potential homebuyer, connect with a trusted real estate advisor today to discuss what that could mean for you if you wait even longer to buy.

Courtesy of Keeping Current Matters

COVID-19 Update: For any news and updates on the COVID-19 Pandemic in San Diego, click here.

San Diego Internationl Film Festival: Oct. 14-24

Villians in the Village: Oct 23

The Haunted Trail: Sep 24 - Oct 31

Not So Scary Fall Festival: Oct 17

Sarah Cancel United Real Estate San Diego DRE 02055221 (619) 253-0296, sarahcansellsd@gmail.com

Information Deemed Reliable But Not Guaranteed

Some real estate firms do not participate in IDX and their listings do not appear on this website. Some properties listed with participating firms do not appear on this website at the request of the seller.

The information provided by this website is for the personal, non-commercial use of consumers and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing.

Some properties which appear for sale on this website may no longer be available because they are under contract, have Closed or are no longer being offered for sale

This content last updated on Thursday, April 18, 2024 11:15 AM from SDMLS.

This content last updated on Friday, April 19, 2024 5:30 AM from CRMLS.

Some properties which appear for sale on this web site may subsequently have sold or may no longer be available.

Franchise Offices are Independently Owned and Operated. The information provided herein is deemed accurate, but subject to errors, omissions, price changes, prior sale or withdrawal. United Real Estate does not guarantee or is anyway responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. Please verify all facts with the affiliate.

Copyright© United Real Estate

Privacy Statement-Terms Of Use

If you are using a screen reader, or having trouble reading this website, please call our Customer Support for help at 888-960-0606 .

Web Content Accessibility Disclosure Statement:

We strive to provide websites that are accessible to all possible persons regardless of ability or technology. We strive to meet the standards of the World Wide Web Consortium's Web Content Accessibility Guidelines 2.1 Level AA (WCAG 2.1 AA), the American Disabilities Act and the Federal Fair Housing Act. Our efforts are ongoing as technology advances. If you experience any problems or difficulties in accessing this website or its content, please email us at: unitedsupport@unitedrealestate.com. Please be sure to specify the issue and a link to the website page in your email. We will make all reasonable efforts to make that page accessible for you.

Leave a message for Sarah